Access the TCI Webinar Recording Below

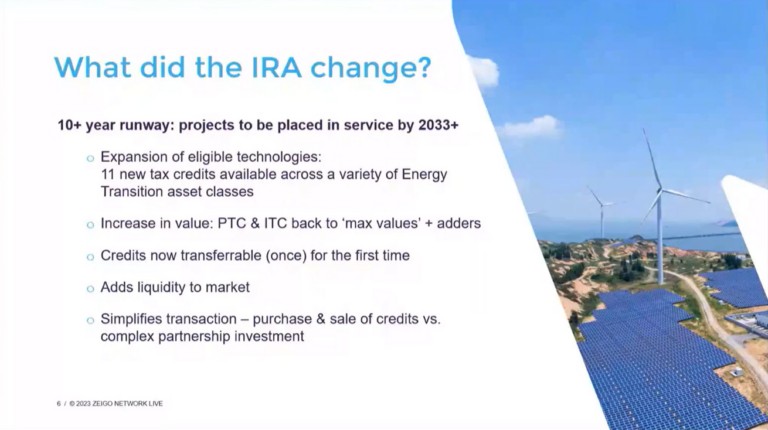

Large corporations are feeling the pressure to decarbonize more than ever. Identifying solutions that both have a meaningful environmental impact and are financially viable can be a challenge. The recent US Inflation Reduction Act (IRA) has led to a new renewable procurement category that has the potential to meet both of these goals: Tax-Credit Investing (TCI).

Curious about renewable energy tax credits?

In this session, experts from Schneider Electric, Holland & Knight and ENGIE explore:

- What is a Schneider Electric Tax Credit Investment (TCI)?

- Why are TCIs ideal for corporates?

- The impact of the IRA on the tax credit investment opportunity

- How TCIs facilitate renewable energy procurement

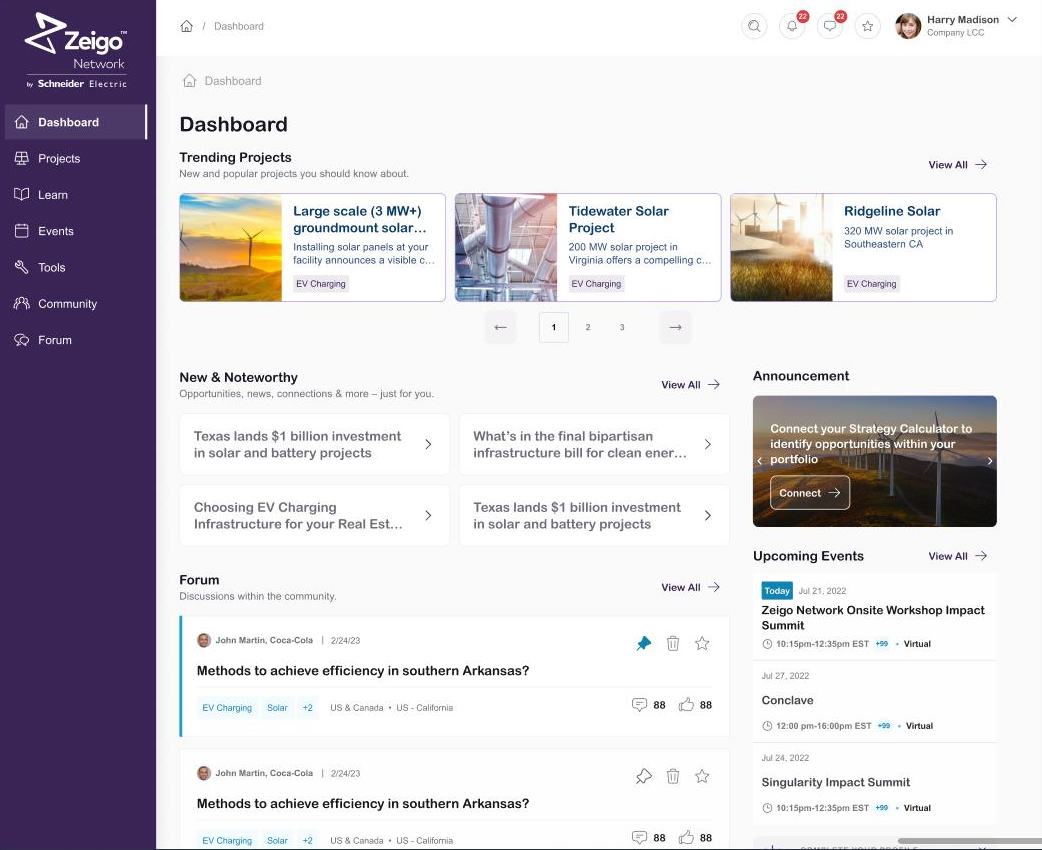

Continue learning in the Zeigo Network

Deepen your knowledge on renewable energy and clean technologies through videos, webinars, and more when you tap into the expertise of our energy and sustainability specialists, recognized as global leaders on corporate renewable energy purchasing and decarbonization.

Join the Network