Why is it still so difficult to purchase power from clean energy sources?

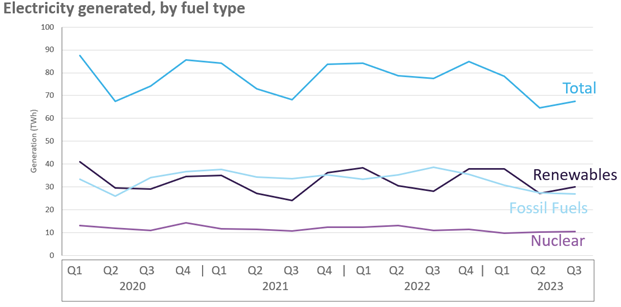

The demand for renewables is growing, and corporate energy buyers have made it clear that they want more of their electricity to come from traceable carbon-free sources. This is evident by the climbing number of RE100 members, totaling over 400 companies. In response, the production of clean energy is rising, evidenced in the UK as renewables accounted for 42% of total generation in 2023, a 3% increase in 2022. While the graph below shows that renewable and fossil fuel generation has fluctuated in recent years, fossil fuels have been on a steady decline since Q3 2022, as renewables have climbed. However, purchasing green energy remains a less-than-straightforward process and despite the justifiable excitement around new routes to green power, how to select and implement them responsibly is a specialized skill set all on its own.

In this article, we have looked at how private and public sector drive for renewable energy has facilitated significant progress, but also made a complex matter even more so.

Source: Energy Trends September 2023: Section 5.1: Electricity (chart 5.2). Information correct as of September 2023.

The Policy Landscape

Whilst energy markets remain in a period of change due to geopolitical factors, companies and governments have continued to shift towards renewable power. The EU revised the Renewable Energy Directive and set a binding target of growing the share of renewable energy to 42.5% by 2030. As well as this, they have provided different sectors with specific targets to reach overall EU targets and plan to improve permitting processes to avoid bottlenecks.

National governments have also implemented regulations to encourage the private sector to transition to green energy. As a result, investment in technologies like wind and solar has rapidly reduced the cost of production. Indeed, over the last decade, the global average cost of electricity generated by renewables has declined, with the largest decline being for solar PV. Due to economies of scale and increasing investment, the lifetime costs of renewable energy sources are now often lower than fossil fuel plants making them a financially viable, and sustainable, option to power company operations.

Yet, whilst policy is an overall positive force for the transition, an everchanging mix of subsidies, emissions trading mechanisms, and certificates in the midst of increasing scrutiny is difficult for the typical buyer to understand, and determining how to benefit for these schemes is not straightforward for the buy or sell side. Indeed, each country in Europe has its own regulations. For example, in 2023 the UK published their plans for ‘Powering Up Britain’, which plans to achieve Net Zero whilst building energy security; then there is the Ten Point Plan, changes to the certificate market following Brexit and the ever-growing interest in REMA and how we may adapt and evolve in response. All of these changes are also happening against a backdrop of other variables: intermittent renewable generation, technology advancements, new market entrants and steady reductions in the cost of renewable generation versus traditional sources. It is easy for one to become disheartened when the legislative landscape changes once again just as they get to grips with the last update. Spain is another notable market for policy updates which can be hard to keep track of, showing that this is a challenge faced by companies all over. Therefore, it is important to acknowledge that while policy has opened many doors, it has not necessarily made green procurement easy.

How Companies Buy Renewables Energy is Changing

As policy support has matured, more routes to clean energy procurement have emerged. One of these routes is via a Power Purchase Agreement (PPA). Within the EU, it has been proposed in a review of the Electricity Market Design (EMD) that PPAs are seen as a tool to support corporate buyers achieve price stability and green procurement. Support for PPAs is also seen at national level, with BPIFrance announcing a Guarantee Fund to support adoption of PPAs in the region. As support for PPAs grows it will surely create a flurry of conversations as new buyers look to enter the market.

Power Purchase Agreements (PPAs) come in two structures:

- In a Physical PPA, the buyer agrees to purchase a specified amount of electricity generated by the renewable energy project at a fixed or indexed price over a defined period. The electricity is physically delivered to the buyer through the electricity grid through a sleeving party and both parties must generate and consume on the same grid.

- A Virtual PPA (VPPA) is a financial contract between a corporate energy buyer and a renewable energy project developer. This pricing structure works similar to a CfD where there is a strike price and the buyer will pay back the difference if the market price is lower than the agreed price whilst the developer pays back the difference if the market price is above the agreed VPPA price. Unlike Physical PPAs, VPPAs can be between parties active on different electricity grids.

As you can see, even at the highest level PPAs have complex variations. Considering this against the fact they sit in an arena subject to the policy changes, there is a clear need for a buyer to understand the benefits and level of commitment required if looking to enter a PPA as part of their procurement strategy. However, one thing remains certain, PPAs continue to be seen as an impactful route to decarbonization – particularly for buyers not able to reach their targets via onsite solutions.

From Complexity to Simplicity

So, reflecting on all of this, where do buyers interested in a PPA go from here?

Even if you can get to grips with technological, contractual, and regulatory complexity, there are still the normal market risks around price, project execution, and operations attached to any renewables project. They all need to be mitigated and managed. Thankfully, as PPAs grow in demand, software solutions like Zeigo Power simplify the process alongside the support of qualified experts to take you through RfP and Term Sheet negotiations.