Looking back on 2023, the UK power market is still to recover from the extreme price volatility experienced in recent years. In a bid to achieve stability, interest in PPAs is continuing to grow following a brief stall in 2022. As corporate buyers come to us to determine if a PPA is suitable for their energy and decarbonization strategy, the most common question we are asked is “How can they be a sound economic investment considering their current costs in comparison to forward curves predictions?”. With this in mind, we’ve taken a look at what goes into a PPA price to understand what makes them competitive in an environment when the high-level data doesn’t initially seem to suggest this, and why the focus should be on how PPAs can support the diversification of your procurement and decarbonization strategies.

What Are The Current Price Trends?

First, a recap of the UK power market over the past few years. It will come as no surprise to anyone that wholesale market prices reached historic highs across Europe in 2022, and the vulnerability of the UK’s energy security became undeniable. Although prices have fallen, experts agree that it is unlikely prices will return to levels seen before the Russia-Ukraine War this decade with forward curves still averaging at 80.49GBP/MWh.

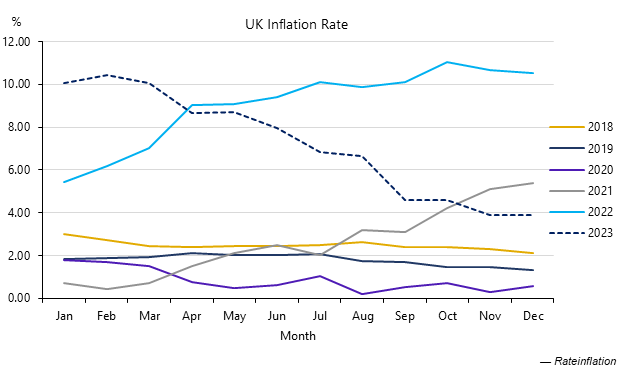

As power prices climbed, so too did the cost of building and operating renewable assets; as can be seen in the graph below, despite a gradual decline, the UK’s inflation rate remains high. This will have long-term impacts as the increase in Levelised Cost of Electricity (LCOE) will push up PPA prices to achieve project bankability, shown in the 20% increase in offer prices received on the Zeigo Power platform between 2022 and 2023, averaging at 92.32GBP/MWh for 2023.

REGO Market Trends

So, are we simply in a situation where a buyer must choose between the lowest cost or decarbonization? Thankfully, it isn’t as straightforward as this and the economics of a PPA incorporates more than just the price of power. Typically built into the price per MWh paid are two commodities – the power itself and Guarantees of Origins.

Guarantees of Origin (GoOs), known as REGOs in the UK market, represent 1MWh of renewable energy generated and are required for corporates to claim decarbonization. As emphasis on traceable decarbonization has grown, so has the demand for these certificates; however, it hasn’t always been the case that they were in high demand. Looking back at the market in 2014, REGOs were often in surplus and essentially bundled into a PPA free of charge. As corporate need for traceability grew with the number of companies making climate commitments, so did REGO price levels with their value slowly climbing towards 30p to 50p by 2020, and those attributed to Wind and Solar assets were valued higher than other technologies.

The market reached a key point in price acceleration when in January 2021 the EU no longer recognised UK REGOs, raising concerns of a reciprocal policy being implemented in the UK. At this time significant numbers of EU GoOs were imported into the UK in order to gain exemptions from UK levies used to pay for CfD and non-CfD Feed In Tariffs. In July 2022, after much uncertainty, the UK government announced they would no longer recognise EU GoOs from April 2023. As such, the April 2022 to March 2023 compliance period would be the last in which EU GoOs, which had historically addressed 25% of buyer demand, could be applied. This fueled the inexorable rise and prices reached £2.50/REGO and on towards £4/REGO by the year end before ultimately reaching record levels in excess of £25/REGO in 2023. Despite a relative levelling off from October’s highs, REGOs remain a significant cost and were once again showing an upward price trend as 2023 came to a close.

Energy Procurement Diversification & Market Hedging

Considering the above, we return to the question “How can PPAs be a sound economic investment considering their current costs in comparison to forward power curve predictions?”. The answer lies in energy procurement diversification, with PPAs playing a fundamental role. Energy buyers who develop a portfolio of access to green energy are increasingly seeing PPAs as a sensible yet impactful strategy to gain a competitive advantage.

The hedging capabilities of PPAs help buyers achieve stability against Power and Certificate market volatility. In addition, by allocating only a proportion of energy consumption to a PPA, concerns over locking in a PPA price above future Power and REGO market-rates are reduced. Furthermore, the potential benefits of a known source of renewable power and the ability to claim additionality for new build projects supports the increasing trend of recognizing sustainability in annual audits. The clear evidence of renewable purchasing PPAs provide can also be communicated with customers.

Hedging is a Long-Term Game

As market conditions make it unlikely PPA prices will return to rates seen a few years ago, energy buyers have understandably asked why they should be regarded as viable.

The answer involves the diversification of your procurement strategy and hedging a proportion of your consumption against future market volatility. Whilst it cannot be guaranteed a PPA price will always remain below market rates, it is likely to be at various point throughout the duration of the contract. A PPA therefore supports diversification whilst providing an impactful route towards decarbonization. Furthermore, the conversation no longer only considers a hedge against power prices but also REGO market fluctuations as buyers are pushed to demonstrate their decarbonization in line with CDP and RE100 guidelines.

Buy Renewable Energy Now

Corporates looking to sign PPAs can find both operational and new build projects on the Zeigo Power platform.

Get Started