Russell Reading, Head of Decarbonisation and Energy Markets for Zeigo Power speaks on why it’s a good time to get a CPPA in the UK.

Interest from Corporates in a CPPA as a route to decarbonising their electricity supply continues at a high level – but is now a good time to tender?

The simple answer is yes. Here’s why…

- The supply of projects in the UK is good. At the moment there are more projects than buyers, meaning that the recent sellers’ market (driven by high energy prices) has swung in favour of buyers – with tenders seeing good levels of responses.

- There are a good mix of projects available with a range of prices.

- We are seeing more smaller projects coming forward.

- Power prices are stabilising again, which means that the costs of balancing a PPA should start to come down from the high levels caused by high and volatile energy prices.

- CPPAs are still a good hedge against future energy price volatility.

- When CfD Allocation Round 6 completes in August / September there may be more projects still available – though these will likely be bigger projects.

- Demand for renewable energy is high which is squeezing UK REGO supplies and keeping prices high in the medium term.

- CPPAs remain an excellent way of decarbonising electricity supplies and taking steps towards Net Zero.

Energy Prices

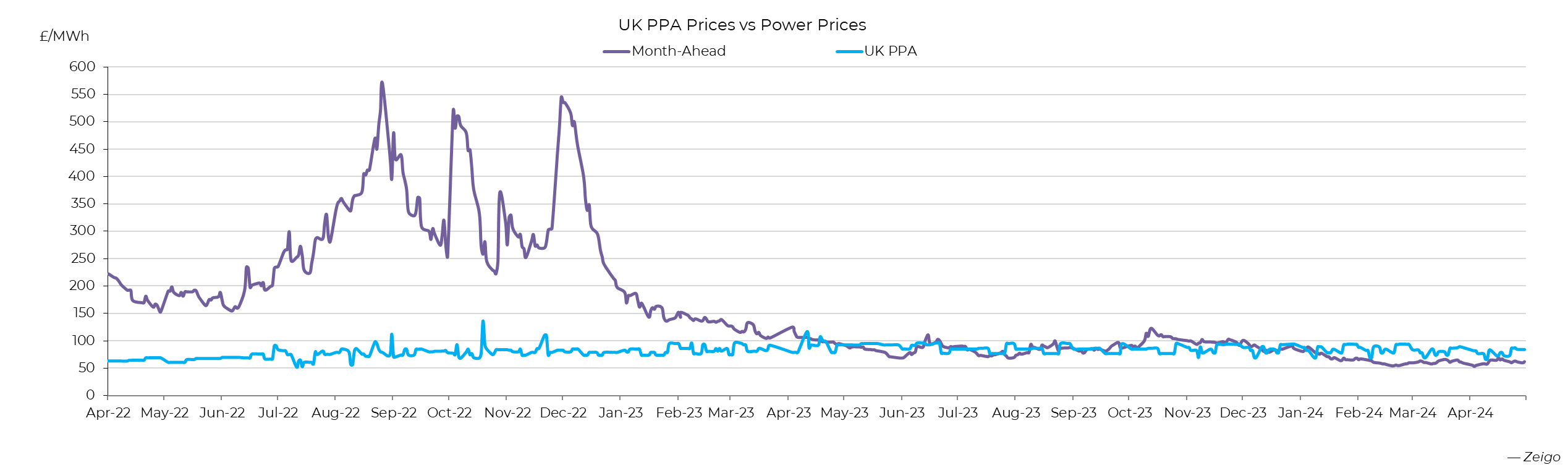

Prices in the UK electricity market have been through a period of unprecedented change and instability through the covid pandemic and the Ukraine conflict. Only now prices are beginning to show some signs of stability, with prices having dipped to the low £60/MWh in March but now looking around £75/MWh for the next two years.

UK CPPA vs. Power Prices

With PPA Prices ranging between £65/MWh and £85/MWh in the UK, the market is looking more balanced for PPAs vs market prices. When the REGO is considered as well, this is included in the CPPA price but would be an uplift of £7 to £10/MWh.

This makes the case for CPPA more aligned to the market prices in the short term, with CPPA Prices around £65-£85/MWh and green energy around £83-£85/MWh.

What is the price Outlook?

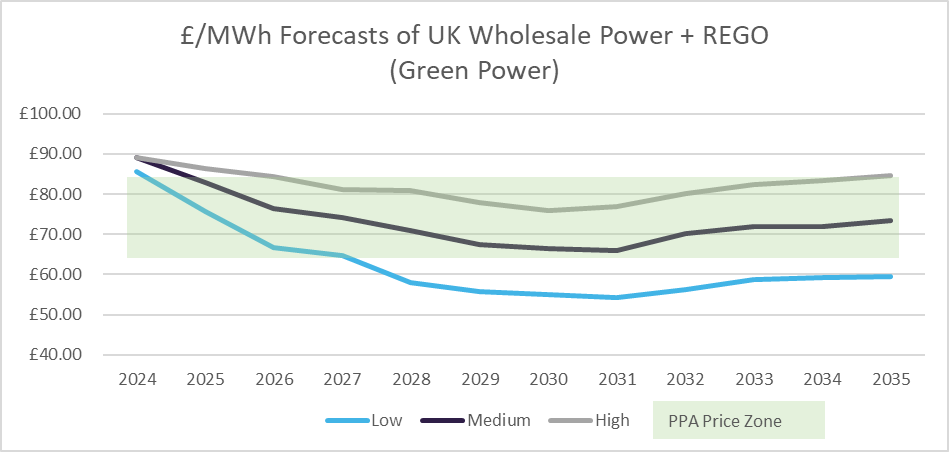

When looking at wholesale energy there are many different views on where power prices may go. Most of these are in the range of £58/MWh to £76/MWh for “brown” wholesale energy over the next 15 years.

On REGOs, the outlook is for no rapid growth in REGO volumes available as there have been issues in the AR4 and AR5 CfD auctions and grid delays causing slow commissioning of new renewable facilities. This suggests little growth in REGO supply until 2026, holding up prices in the short term. Concerns exist that the demand for REGOs will outstrip supply pushing REGO prices up and maintaining them around current levels.

(source Zeigo power)

This means that the longer-term outlook for green power could be between £62/MWh and £82/MWh on average over the next 15 years in today’s money. The CPPA also provides a crucial element of price stability in a buyers energy portfolio, meaning that as part of a balanced purchase portfolio the CPPA can mitigate against price rises, and market price purchasing can deliver benefits of falling prices. The balanced purchase portfolio giving reduced exposure to market prices whilst still allowing some downside benefit and upside protection.

Although lower energy prices make the financial case closer, and less of a “no brainer” than it has been in the height of soaring energy prices, the good news is that CPPA prices will be less likely to contain a “premium” reflecting those high market prices. This makes them better value over all in the long term now. Buyers are also considering that PPAs that seemed marginal vs market a few years ago around £55/MWh would be very much in the money now.

Energy Price Volatility

The geopolitical situation globally has been volatile in recent years and there has been (and some would say remains) significant chances for further instability – with a knock on to gas and electricity prices.

Mitshbishi Electric’s survey “Energy on and Industrial Scale” showed that in January of this year, 91% of the interviewed senior decision-makers working in UK manufacturing were concerned about energy price security. The same research also found that 85% of those asked felt that net zero was important to their business but only 35% were currently implementing it. High prices have not only impacted profitability but have delayed net zero actions and investment (people or equipment).

Corporate PPAs are a way of gaining an element of price certainty that organisations desire in their electricity purchasing portfolio as well as taking an important step towards net zero.

Project Supply

When energy prices were high there was a peak in interest in CPPAs and there were more buyers than PPA projects available. This led to a seller’s market. As these organisations have completed their PPAs and the short term financial benefits were less clear cut the number of organisations looking at CPPAs slowed. At the same time, renewable energy projects keep coming forward so the market is now moving to a buyer’s market – with each new CPPA tender getting many responses and more competitive offers.

This can also reflect in the negotiation of the PPA, making it easier with better balance between buyer and seller in the deal – and a willingness for more flexibility on both sides.

In addition, the market for CPPAs is more mature (not fully mature though) than it was pre-Covid pandemic. There are now a greater number of parties with more experience in PPAs who can be helpful partners in getting a PPA done (not-so-subtle plug for Zeigo Power here).

In the UK the Contracts for Difference (CfD) scheme has been an important route for developers to get new projects built. But issues around Allocation rounds 4 and 5 have meant a greater interest in other routes to markets via suppliers and CPPAs. The good news for CPPAs is that Suppliers can struggle to accept the risk of a long-term fixed price, which is something that the Corporate is happy to do – making the CPPA the natural choice here.

As of today, we see really good availability of projects with a mix of technologies, start dates and price points. There is a range of prices because some projects may also have better established supply chains which can see them being competitive based on this. We have also seen projects withdrawn from the CfD process becoming available for CPPA at good prices.

In addition, we are seeing more smaller projects coming forward as connection of a smaller project to a Distribution Network may prove quicker than connection of a larger one to the Transmission Network. This is especially true if the asset can be situated further south in the UK. Whilst these might have a price premium, they are more accessible to smaller organisations who cannot take large energy volumes from bigger projects. This means that CPPA are more accessible to smaller organisations. Alongside this we are seeing growth in multi-buyer PPAs where a group of smaller organisations gather together to do a PPA.

Other Factors

A corporate PPA remains the main way to deliver additional carbon savings (additionality) when decarbonising electricity supplies. REGOs + Power cannot do this.

In addition, the public perception of helping to build a new wind or solar farm and taking the power from that is much higher than buying REGOs. Some see buying REGOs as “greenwashing” and the minimum that seems to be expected is to buy both power and REGOs from a generating asset (Physical CPPA).

We have seen significant traction in CPPAs because stakeholders or customers expect organisations to invest in and buy clean electricity and they understand that to mean “from source”.

EY’s PPA Index shows the UK remains in 4th place on PPA attractiveness index – underscoring the fact that despite a slow start to the year the UK PPA market is picking up from all the positive factors above.