Multi Buyer PPAs; Multi Seller PPAs – how about Multi-Technology PPAs?

Whilst the concept arguably still remains in its infancy, the past 12 months or so have seen an interesting uptick in the number of multi-technology PPA offers submitted through the Zeigo Power Platform for our corporate client RFPs.

What is a Multi-Technology and “Portfolio” PPA

So, let’s start with the basics; what are multi-technology and portfolio PPA’s?

A multi-technology PPA covers more than one source of renewable technology such as wind, solar, biomass, hydro or geothermal. The general principle behind this structure is that the uncorrelated generation profiles (e.g. Solar PV vs Wind) have the potential to offset the intermittent volatility of a single renewable energy project and assist the buyer in managing the shape, balancing and volume risks associated with their own consumption profile.

On a similar note, there are portfolio PPAs – also known as a multi-location PPAs. Here the idea is similar, however you can package and bundle up assets within the same technology bracket (e.g. wind) into a single PPA price, whilst still remaining subject to different variable generation profiles. To give an example Corporate A would like to enter a 100 GWh UK PPA contract; Developer A puts forward 2 wind assets, one in Scotland (50 GWh) & one in the Southeast of England (50GWh) from their portfolio. Given the weather, wind speed and topography considerations, the P50 output profile of each wind asset could have noticeably different generation profiles.

Who is offering multi-technology PPAs and why are they doing it?

Traditionally, it’s been the industry’s biggest names from the utility, developer & generator side that are capable of packaging up and submitting these offers, whilst at the same time understanding the intricacies and commercials. That being said, we are increasingly seeing smaller boutique developers looking to move into this space, who’s aim is to seek optimisation amongst their portfolio and identify a more nuanced route to market by combining several assets.

More commonly these PPA offers tend to originate from existing prebuilt operational assets, where output data flows are captured, detailed, and well known. On the flip side, for new build assets there will always be a certain degree of uncertainty on the assets performance until it undergoes energisation and connects to the grid. In spite of this, modelling is ever more sophisticated each year with the availability of historic weather data for specific sites and it’s not unheard of to see a combination of new build assets bundled up and presented to corporates.

As alluded to above, portfolio management and optimisation are key commercial drivers here for developers, utilities, and generators. Whether the IRR will be highest through a single asset PPA or portfolio PPA is bespoke and will depend on a multitude of complexities. A dedicated power market model can estimate those cost effects into the future.

The same could be said on the corporate side, an NPV assessment of a single asset PPA vs a Portfolio PPA will depend on a vast array of factors. One factor is the overlay of the corporate’s consumption profile vs combined generation output accounting for forecasting errors. Furthermore, on this basis, how clear-cut are the firming costs for the residual volume.

Multi-Technology PPA – Risk Management

So, what are the major risks that multi-technology or Portfolio PPAs seek to address and how does it work?

Shape Risk

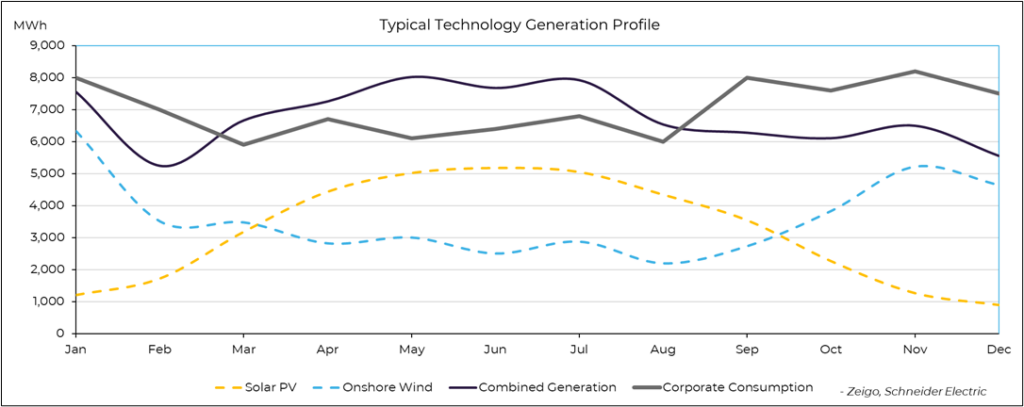

The first topic to cover is shape risk. As you can see on figure 1 below, the standard generic profile for a Solar PV asset tends to be an “n” shape (high production in summer), whilst Wind tends to be a bit more unpredictable and more of a “U” shape (high production in winter).

A multi-technology “as produced” PPA has more of a “flat” baseload style profile compared to a single asset, so the amount of time both wind and solar assets produce insufficient power for the corporate buyer to cover their flatter demand curve (in a lot of instances) tends to be less.

Consequently, the combined generation of multiple projects may influence a corporate buyer to consider the incurred costs of variable generation and view the shaping costs as potentially less than against a single technology asset. This is particularly relevant for Physical PPAs where your assigned supplier/sleeving party will charge variable fees to account for shape risk.

Relevant to the argument here, the past few years have swung the EU electricity market in the sellers favour whereby demand outstrips supply and more developers have decided to withdraw Baseload PPA’s from the sales market. So, the multi-technology approach could be considered as an interesting innovative alternative.

In future, if we are to shift and move back into a buyer’s market or more neutrally balanced scenario, where the seller is more accepting of taking accountability for shape risk, a multi-technology PPA may enable the seller to conveniently offer a firm or shaped commitment, as the risk and cost of managing this in house or through a 3rd party is manageable.

Figure 1. Corporate Consumption vs Technology Type.

Volume Risk

Another risk to be associated with as produced PPAs is volume risk. Signs are that Climate Change is beginning to subject us to more extreme weather events. By means of diversification through several technology types within the PPA, a corporate can reduce their exposure to such extreme weather scenarios and subsequent generation variability (both low & high). Ultimately a multi-technology PPA approach could lead to a more balanced volume exposure, whereby one technology falls below expectations.

Balancing Risk

Thirdly we have the balancing question, what happens when forecasted generation is different from actual generation? Under a multi-technology approach, it’s possible to group different technologies and house them collectively for balancing purposes. As this could be seen as easier to manage, and especially pertinent to Physical PPAs, it could result lower charges being set by your assigned balancing responsible party due to accounted for risks.

Lower balancing fees combined with lower shaping costs could potentially considerably change the commercial, financial and business case for the PPA in question. Even more so, if the price of the multi-technology PPA is only a few GBP/MWh more than a single standalone asset, you could recuperate these charges back through your 3rd party sleeving party & balancing responsible party.

Downsides?

So, everything so far sounds too positive? On that you would be right. Like everything there is always advantages and disadvantages.

One major downside of multi-technology PPAs is around the question of how to handle the issues related to individual projects on a contractual basis. Let me put one scenario in front of you – you negotiate a multi-technology for a new build wind & solar asset, what happens if the Solar PV asset fails to get planning permission? Would you look at a replacement project clause? What if one is not available? In that scenario does the overall PPA effectively default or is there a partial default & termination.

Overall PPAs are very challenging to complete and face an extensive negotiation period, adding an additional layer of convolutedness through this structure may not be for the faint hearted, who are familiar with how difficult finding agreement on PPA arrangements can be and how prolonged negotiations can last.

Storage

At this point, some of you readers may point to storage (batteries) and argue that this is another way to address some of the aforementioned risks.

Battery PPA’s aka “Hybrid PPAs” are expected to play a key role in future electricity grid’s – enhancing the reliability and flexibility of renewable energy sources. By storing excess energy generated during periods of high production and releasing it during periods of low production, energy storage can help balance supply and demand.

While interest in energy storage and PPAs is growing, market participants are in general still figuring out the best ways to structure and implement these agreements. The first Hybrid PPAs have been signed in the EU but this is still a nascent technology and understanding how the battery system fits into the commercial contract is still under debate. So perhaps those corporates who need to move now, could consider the multi-technology PPA option whilst baseload products are also still at a premium in today’s market.